It can be difficult to find the right sustainable investment as there are many factors to consider. There is also quite a bit of vocabulary that one has to learn in order to understand what a particular investment is all about. In this article we’ll cover the basic terminology and point out some key things to look at when choosing sustainable investments.

Probably the most common abbreviation that you’ll encounter is ESG, which stands for Environmental, Social and Governance. These factors are included on top of the traditional financial analysis to uncover potential risks and opportunities that can impact the performance of an investment. Financial performance remains to be the main objective and choosing investments with good ESG practices is seen as a way to drive returns while avoiding risks that could inhibit them. [1]

Secondly, SRI is an abbreviation of Socially Responsible Investing. This term is often used interchangeably with ESG. However, SRI goes one step further by excluding investments according to personal values and ethics. For example, an investor might avoid any fund that contains companies engaging in weapons production. Making a profit is still important, but not at the expense of violating one’s principles. [1]

Finally, impact investing refers to the practice of prioritising the non-financial positive outcome of an investment. The objective is to help an organization reach specific goals that are beneficial to the society or the environment. [1]

More and more funds are labelled with one of these terms. Correspondingly, a whole range of ESG indexes have been developed. Indexes track the performance of a group of stocks and serve as a benchmark for funds that seek to replicate them [2].

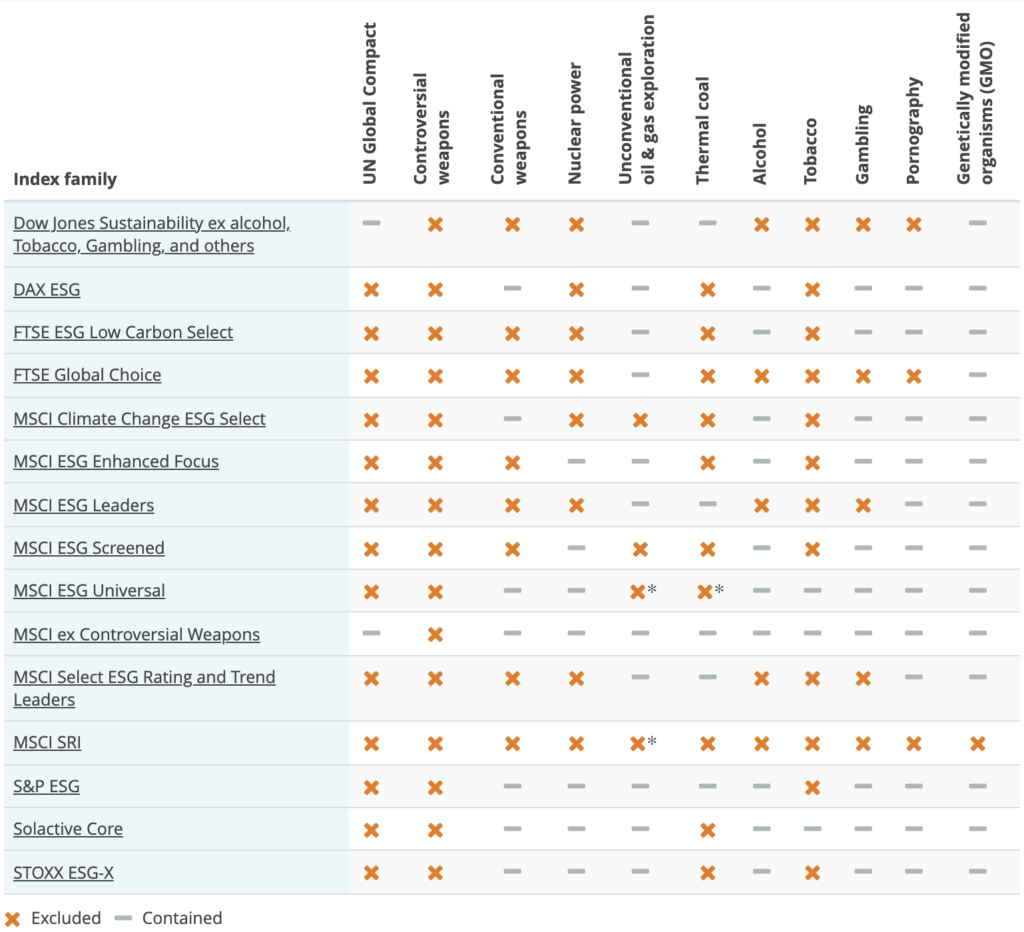

It should be noted that there is a lack of consensus of what an ESG or SRI index should exclude. In fact, the approach of various indexes to excluding particular sectors differs significantly and you should take a closer look to find out which most closely matches your personal preferences. See the table below to get a quick overview of which sectors are excluded by some of the major indexes [3]:

Moreover, it is not always as straight-forward as simply excluding an entire sector. There are alternative strategies, such as the best-in-class approach, which selects the top companies in a sector based on their ranking according to the ESG criteria [4]. This way you can for example end up with oil companies in an ESG fund, albeit only with a few that are deemed to be the best of the bunch. Active ownership through voting or other engagement activities is also an important part of sustainable investing as it represents an opportunity to influence the behaviour of companies [5].

You can also invest in thematic funds such as those focused on renewable energy or pick individual stocks. But how can you tell exactly how sustainable a company is? Lehti can be especially helpful when trying to see the environmental impact of individual stocks and to compare various funds.

However, do keep diversification in mind. By investing only in a few companies or thematic funds, your portfolio might become too industry specific, which can leave you exposed to increased risk and possibility of significant losses.

Furthermore, whatever investment you choose, you should always do your due diligence and consider your individual circumstances. Think about what your investment objectives are and how you want to incorporate sustainability into them. What is your investment horizon and risk tolerance?

Last but not least, you should always keep the cost in mind. Fees and various other expenses can have a significant impact on the performance of your investments. Key metric to focus on is the Total Expense Ratio (TER), which captures the annual cost of owning a fund [6]. You can find it on the fund’s website or in the Key Investor Information Document (KIID). Nevertheless, keep in mind that some charges may not be included in the TER, especially those that are only made once such as broker fees.

- ESG, SRI, and Impact Investing: What’s the Difference? https://www.investopedia.com/financial-advisor/esg-sri-impact-investing-explaining-difference-clients/

- Index https://www.investopedia.com/terms/i/index.asp

- The best socially responsible (SRI) ETFs https://www.justetf.com/en/how-to/invest-in-social-responsibility-europe.html

- Best in class https://www.robeco.com/en/key-strengths/sustainable-investing/glossary/best-in-class.html

- Active ownership https://www.robeco.com/en/key-strengths/sustainable-investing/glossary/active-ownership.html

- Cost of ETFs: Total Expense Ratio (TER) vs. Total Cost of Ownership (TCO) https://www.justetf.com/en/news/etf/cost-of-etfs-total-expense-ratio-ter-vs-total-cost-of-ownership-tco.html

to learn more about Lehti and try out the Beta version